As the 3D printing industry grows, new trends are emerging and the overall uses of the technology are evolving. Companies around the globe are expanding their efforts in new directions and are embracing what it has to offer in end-use products, prototyping and tooling among its many other uses. Here’s a look at the specific ways the industry is evolved in 2019:

Global Growth Forecasts

In general the industry is growing, with multiple forecasts showing exponential increases in both spending on 3D printing and usage. The Wohlers Report 2019 predicts that by 2020 all AM products and services worldwide will be at $15.8 billion. The company expects following revenue forecasts to climb to $23.9 billion in 2022, and $35.6 billion in 2024.

The 3D printing industry is broadly categorized into Desktop and Industrial systems. This growth in the industry is cutting both ways on that front, showing an increase in revenue for industrial machines and a decline in desktop ones. The overall trend is upwards, but smaller printers are showing an overall decrease.

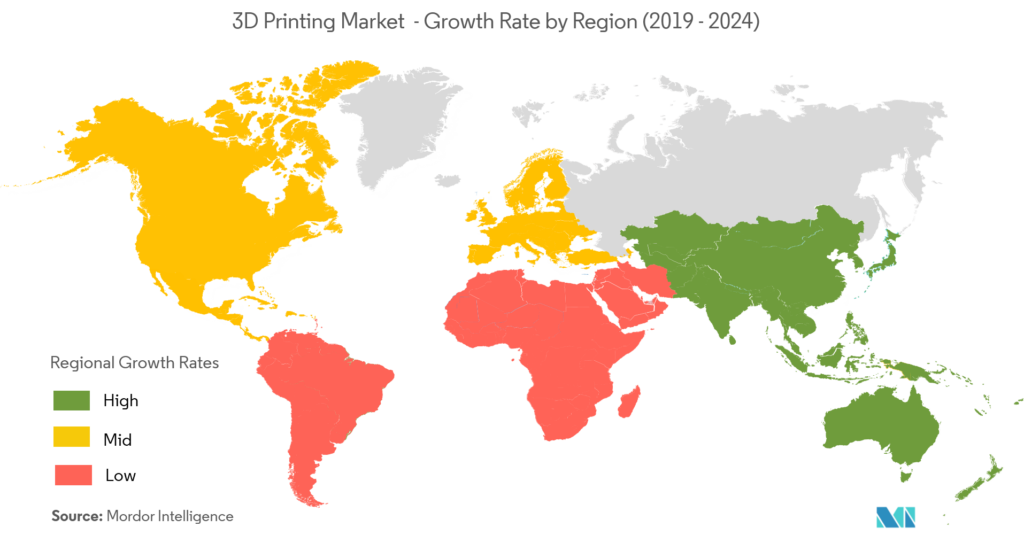

Both the public and private sector are investing more in 3D printing around the globe. North America holds the largest share in the funding of additive manufacturing as a whole, however China and the Asia regions are showing the greatest rate of growth making them formidable competitors in the future. This may also be further bolstered by China’s own ‘Made in China’ initiative, which is likely to boost the investment into private and public sector technologies, including 3D printing and CNC machining (among others).

Another report by GlobalData states that the aerospace and defense industries are a major source of growth for additive manufacturing. This is especially bolstered by the production of spare parts, satellites and engines. The Chinese, Russian and US armed forces are among the most prominent defense manufacturers employing the use of 3D printing technologies.

Europe is also a major hub for the 3D printing industries. Major demand in the region comes from small and medium-sized businesses that are in need of high speed, reliable and low-cost prototypes, which largely in the healthcare and aerospace sectors. Government spending is also seeing some forward momentum. The Dutch government, for example, has invested an additional USD 150 million in 3D printing-related research and innovation. Similarly, Finland has been looking to increase its 3D printing activities through partnerships, while nations such as Poland are also integrating it for the medical field (European cohesion policy).

There are a few constraints on the market, such as the high costs of deploying the technology for industrial levels of production. This may be curbed by the increases in competition within industrial additive manufacturing systems, which could drag down the prices in the future. Another concern factor to the growth of 3D printing is that of reliability and repeatability, which prevents a lot of industrial firms from adopting the technology. This is something 3D printer manufacturers are working on within the industry and will require further advancements to dispel the impression of unreliability and lack of consistency.

An overwhelming amount of respondents in a 2019 survey by Essentium (99%) are planning to increase the level of 3D printing usage at their company. All in all, the industry looks healthy and is growing at an increasing rate according to multiple years worth of forecasts from Wohler’s, Sculpteo and more.

Applications & Industry Demands

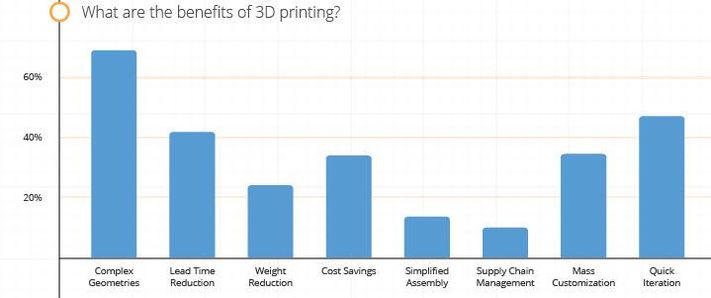

The main uses of 3D printing at this time are in the healthcare, aerospace & defense, industrial and consumer product industries. The companies that often operate using 3D printing tend to find their most interesting applications in creating complex geometries such as lattices. Another factor that many companies find to be an important USP of 3D printing is that of creating quicker iterations of their products. This makes sense, as companies also stated in another study that their top focus for using 3D printing is accelerating product development cycles.

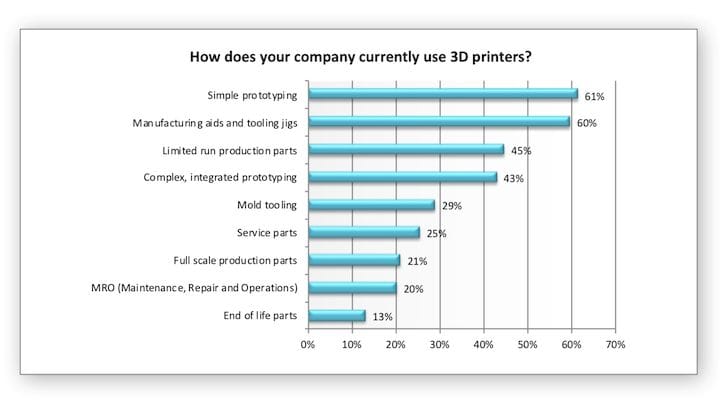

While prototypes and proof of concept are still the most common ways that firms are utilizing 3D prints, production and R&D are also climbing. The former two have seen an increase in usage compared to the past 2 years, while finished good production has largely stayed stagnant. Additionally, as a survey by Essentium has noted, 83% of companies using 3D printing are not employing it for mass production (usually operating on production runs under the 1000s).

Another rise, as indicated by Sculpteo’s survey, is that of spare parts production and an interest in supply chain management. Supply chain management has been a major theme this year in particular, making significant waves in the aerospace and defense sectors. Various organizations like the US Air Force, Navy and airplane manufacturers in general have been using 3D printing for the restoration of older aircrafts and vessels, restoring parts that are no longer in production and decreasing warehousing costs with on-demand production. This can be seen in the cases of 3D printed latrine covers being certified by the US Air Force and the Australian Navy testing out the technology in a recent USD 1 Million trial. Both cases imply more extensive usage in the future.

In looking over the answers of respondents from multiple surveys, we can see that lead-time reduction is a close third factor with cost savings also being fairly important. These are both factors that the 3D printing industry is trying to maximize efficiency in with newer machines. Companies like Spee3D and Aurora, for example, have consistently been developed metal printers that have faster production times than their older models, breaking their own previous records.

Technologies

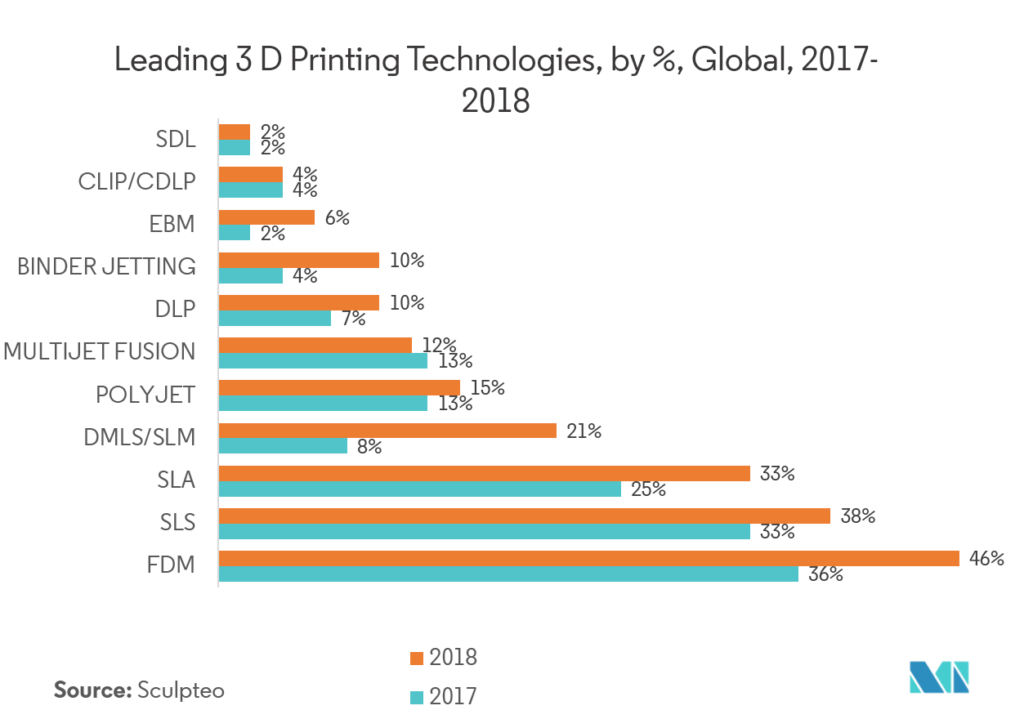

In terms of technologies, FDM/FFF still rules the roost. Most applications for FDM are in that of prototyping and manufacturing tooling and jigs. Limited run production parts also play a major role in this. As mentioned previously, there has been a major rise in industrial printers of larger sizes, which may have played a role in the increasing growth of end-use parts (though end-use parts are still far from the most common usage for 3D printers).

While FDM is the most prevalent for in-house production, other forms of additive manufacturing such as SLS, Jet Fusion and Polyjet have achieved growth through external services. In fact, other than FDM, most other types of 3D printing are more likely to be used through services than through in-house production. While companies are purchasing more printers overall, they have also increased the use of outside services. Both these modes of usage have seen increases.

Similarly, plastic technologies are far more likely to be in-house, while metal printing is more likely to be done through external services. The aeronautics industry is much more likely to use the expensive forms of 3D printing than other users, with many companies spending over USD 100,000 annually. Illustrating this point, while 38% of companies surveyed use SLS, only 15% of them own an in-house machine.

The main barrier to further implementation of 3D printing is budget and reliability, so it stands to reason that the newer, more expensive forms of 3D printing are less common right now. The Essentium study also backs up this point, showing that many companies believe that the expenses associated with 3D printing are preventing it from becoming a large-scale production technology. This may change with more testing and increasing price competition in the future.

Finally, among the companies that are also employing other technologies aside from AM systems, CNC machining was the most prominent companion tech and laser cutting followed as a close second.

Materials

Plastics are the most common material when it comes to additive manufacturing, both in-house and in terms of services. Prototyping, tooling and R&D have played a large role in this and, though other materials also serve these same purposes, plastics are the most commonly used one. However, in terms of percentage of users, plastics and metals both fell as more materials have joined the field overall. In fact, most materials (ceramics, wax, resins and multicolor) have risen in 2019 in terms of usage in-house. These disparities may also be the result of the growth of out-house AM services as an option for many firms.

Despite the drop in in-house usage of metal, revenue from metal printing grew an estimated 41.9%, continuing a five-year streak of more than 40% growth each year. This has been due to many industries upping their production, but most prominently increases in defense and aerospace have pushed the technology forward. However, 50% of metal printing is done through services as opposed to in-house printing.

The usage of resins sits at about 40% in terms of in-house materials usage, a 5% increase from the previous year, while multicolor technologies have risen from 15% to 27%. These numbers are all much higher when including usage through services and mixed methods.

Materials are one of the top concerns for the future growth of AM among firms. More specifically, most firms look forward to seeing more materials introduced and having systems that are more versatile, as new materials ranked second in what growth factors are most interesting to firms, according to Sculpteo. Similarly, machine capabilities and the supply and cost of materials were both the two highest-ranking factors for increasing a company’s 3D printing activities.